About

Gold On Forex Market

what is forex market?

The foreign exchange market, commonly known as the forex market or FX market, is a global decentralized market for trading currencies. It is the largest and most liquid financial market in the world, with an average daily trading volume exceeding $6 trillion. The forex market operates 24 hours a day, five days a week, and it involves participants from around the globe, including banks, financial institutions, corporations, governments, and individual traders.

Key Features of the Forex Market:

1. Decentralized Market: Unlike stock markets, the forex market does not have a central exchange. Instead, it operates over-the-counter (OTC), meaning trades are conducted directly between participants through electronic networks.

2. Currency Pairs: Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The value of a currency is determined relative to another currency, and traders buy or sell currency pairs based on their expectations of how the exchange rate will change.

3.Market Participants: The forex market includes a wide range of participants:

Banks: Major banks play a significant role in forex trading by providing liquidity and executing large transactions on behalf of their clients. Central Banks: Central banks, such as the Federal Reserve (Fed) in the U.S. or the European Central Bank (ECB), can influence currency prices by adjusting interest rates and intervening in the market. Corporations: Companies engage in forex trading to hedge against currency risk in international business operations.

Hedge Funds and Investment Managers: These entities trade currencies to profit from market movements or to hedge against currency exposure. Retail Traders: Individual traders, often using online platforms, participate in the forex market to speculate on currency movements.

Market Hours: The forex market operates 24 hours a day, opening in Sydney, then moving across different global financial centers (Tokyo, London, and New York). This continuous operation allows for trading flexibility across different time zones.

Factors Influencing Forex Prices: Several factors influence currency prices in the forex market, including: Economic Indicators: Data releases, such as GDP, employment figures, and inflation rates, can impact currency values.

Interest Rates: Changes in interest rates by central banks can influence currency demand. Higher interest rates typically attract foreign capital, leading to a stronger currency. Political Events: Elections, geopolitical tensions, and government policies can affect investor confidence and currency values.

Market Sentiment:Traders' perceptions and expectations can drive short-term price movements.

Why Trade in the Forex Market?

High Liquidity:The forex market's size and volume provide high liquidity, meaning large trades can be executed with minimal price impact.

Accessibility:The market's decentralized nature and 24-hour operation make it accessible to traders around the world.

Diverse Trading Opportunities: With numerous currency pairs to choose from, traders can take advantage of different economic conditions and events. In summary, the forex market is a dynamic and complex financial market where currencies are traded. It provides opportunities for hedging, speculation, and global commerce but also involves significant risks due to leverage and market volatility.

why we shall trade Gold on Forex Market?

Trading gold on the forex market, also known as XAU/USD (where "XAU" represents gold and "USD" is the US Dollar), is popular for several reasons. Here are some key reasons why traders might choose to trade gold on the forex market:

1. Safe-Haven Asset: Gold is traditionally considered a "safe-haven" asset, meaning it tends to retain or increase in value during times of economic uncertainty, geopolitical tensions, or financial market instability. Investors often turn to gold to preserve wealth and protect against inflation, currency devaluation, and other economic risks.

2. Hedge Against: Inflation and Currency Depreciation Gold is often used as a hedge against inflation. When inflation rises, the purchasing power of fiat currencies can decrease, making gold more attractive as it tends to retain its value better than paper currencies. Similarly, during periods of currency depreciation or devaluation, gold often serves as a hedge, helping traders and investors protect their wealth.

3. Diversification of Portfolio: Trading gold can provide diversification to a portfolio that may be heavily invested in stocks, bonds, or other currencies. Since gold often behaves differently from other asset classes, it can reduce overall portfolio risk and volatility, especially during market downturns.

4. High Liquidity: Gold is one of the most liquid assets in the world. The high liquidity in the gold market allows traders to enter and exit positions quickly without significant price slippage. This is especially beneficial in the forex market, where quick trades and tight spreads are often crucial.

5. Volatility and Profit Opportunities: Gold prices can be volatile, driven by economic data, geopolitical events, changes in interest rates, and shifts in market sentiment. This volatility can provide traders with numerous opportunities to profit from price movements, whether through short-term trading strategies like scalping and day trading or longer-term trend-following strategies.

6. 24-Hour Market Accessibility: Like the forex market, gold trading is available 24 hours a day, five days a week. This continuous trading allows traders to respond to global events as they happen, rather than being restricted to specific market hours.

7. Correlation with Other Financial Instruments: Gold often has a negative correlation with certain asset classes, like equities and the US dollar. When the US dollar weakens, gold often rises in value as it becomes cheaper for investors holding other currencies. Similarly, during stock market downturns, gold may increase in value as investors seek safety. Understanding these correlations can help traders hedge positions or exploit market inefficiencies.

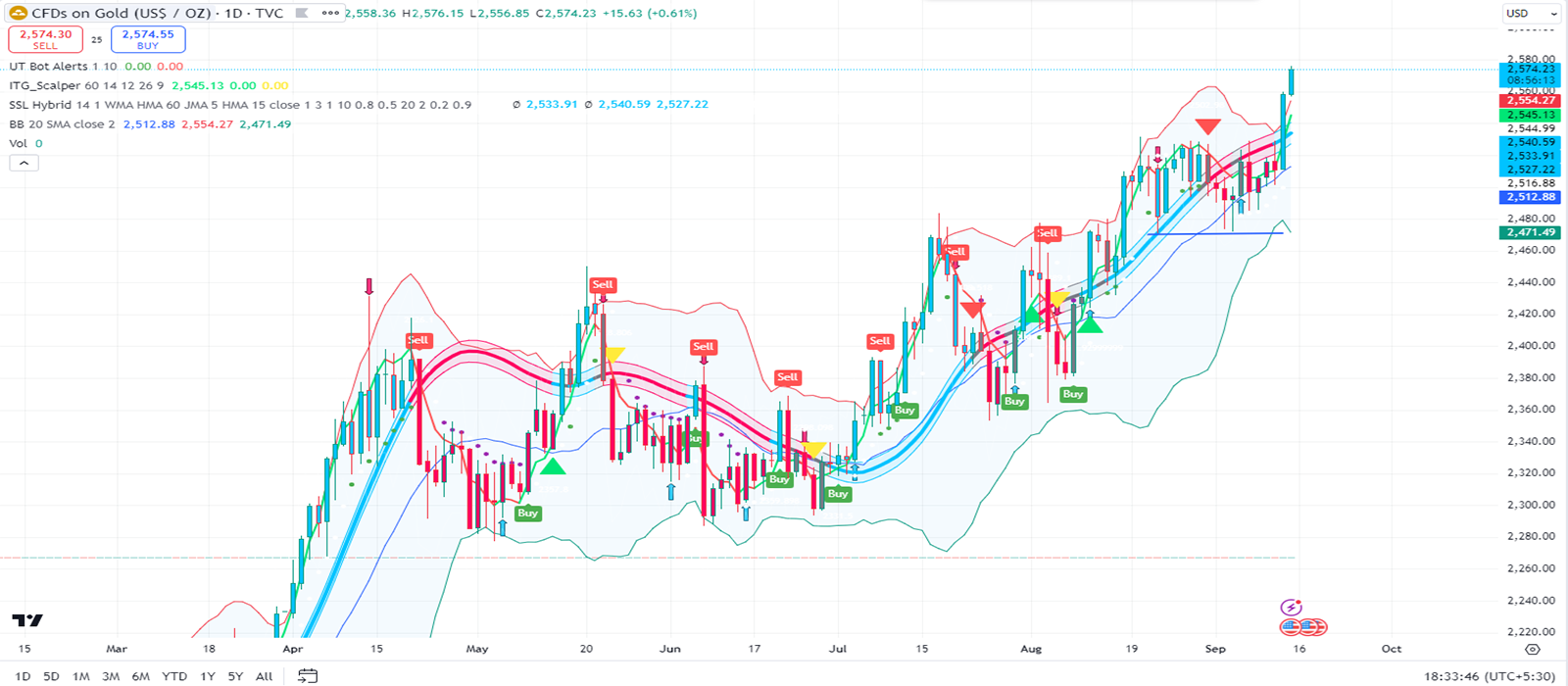

8. Technical and Fundamental Analysis: Gold's price movements can be analyzed using both technical and fundamental analysis. Traders can use technical analysis tools like charts, indicators, and patterns to make short-term trading decisions. Meanwhile, fundamental factors like economic data releases, central bank policies, and geopolitical developments can provide insight into longer-term trends.

9. Leverage: The forex market allows traders to use leverage to increase their exposure to gold without requiring the full amount of capital upfront. This means traders can control a larger position with a smaller amount of money, potentially amplifying both gains and losses.

10. Trading Flexibility: The forex market offers flexibility in trading gold through different instruments such as spot gold (XAU/USD), gold futures, gold ETFs, and gold options. This allows traders to choose instruments that best match their trading strategy, risk tolerance, and investment horizon.

Conclusion : Trading gold in the forex market offers a range of benefits, including acting as a hedge against inflation, providing diversification, and taking advantage of market volatility and liquidity. However, it's important to remember that trading gold, like any financial instrument, carries risks. Traders should carefully analyze market conditions, use sound risk management strategies, and stay informed about economic and geopolitical events that could impact gold prices.

what is prediction of gold price next 10 years if possible with chart

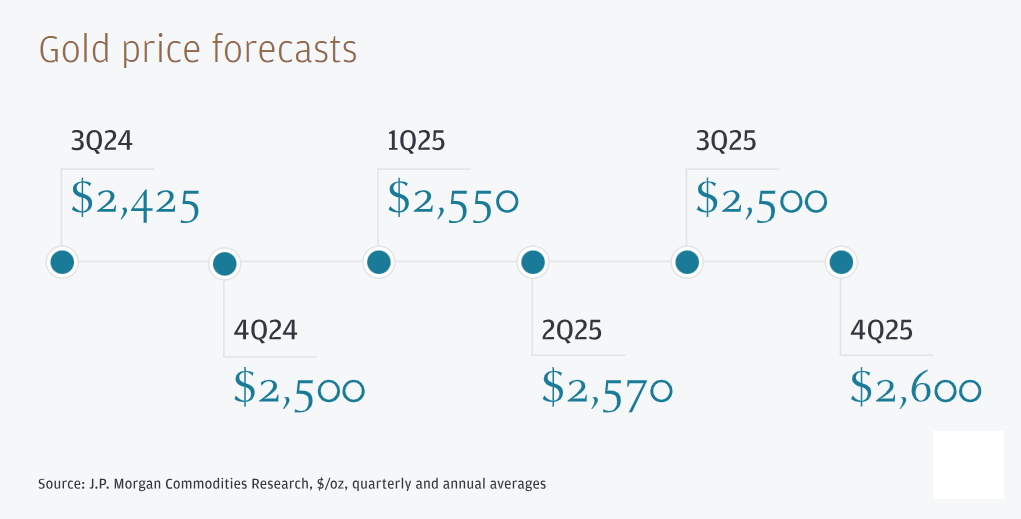

Predicting the gold price over the next 10 years involves a great deal of uncertainty and depends on numerous factors, including economic conditions, geopolitical events, inflation rates, currency values, interest rates, and market sentiment. While it's not possible to provide a precise prediction due to the inherent volatility and complexity of financial markets, I can explain the general factors that could influence the future price of gold and create a hypothetical chart based on some common scenarios.

Factors Influencing Gold Prices in the Next 10 Years

1. Economic Uncertainty: In times of economic crisis or uncertainty, gold often serves as a safe haven asset. If global economies face recessions or crises, the demand for gold could increase, pushing prices higher.

2. Inflation and Interest Rates: Gold is often used as a hedge against inflation. If inflation rates rise significantly, the demand for gold might increase. Conversely, higher interest rates could decrease gold's appeal, as investors might prefer yield-generating assets.

3. Currency Fluctuations:Since gold is typically priced in U.S. dollars, the value of the dollar can significantly impact gold prices. A weaker dollar makes gold cheaper for other currency holders, potentially increasing demand.

4. Geopolitical Tensions:Political instability or conflicts often drive investors to seek refuge in gold, potentially driving up prices.

5. Technological and Industrial Demand:Technological advancements and industrial use of gold, especially in electronics and medical devices, could also affect demand and prices.

6. Central Bank Policies: Central banks around the world hold significant gold reserves. Their buying and selling activities can influence gold prices.

Hypothetical Gold Price Scenarios

To provide a rough idea, here are three hypothetical scenarios for gold prices over the next 10 years:

Bullish Scenario: Gold prices increase steadily due to prolonged economic uncertainty, high inflation, and strong demand from central banks and investors. Prices could potentially exceed $3,000 per ounce. Base Scenario: Gold prices experience moderate growth, influenced by a mix of economic factors like moderate inflation, stable currency markets, and gradual economic recovery. Prices might fluctuate around $2,000–$2,500 per ounce.

Bearish Scenario: Gold prices decline or stagnate if global economies recover quickly, inflation remains low, interest rates rise, and other investment opportunities become more attractive. Prices might drop to around $1,500–$1,800 per ounce.

Creating a Hypothetical Chart I'll create a simple chart to illustrate these scenarios over the next 10 years.

It looks like there was an issue generating the chart. Let me try again to create the hypothetical gold price chart over the next 10 years.

It seems I'm having trouble generating the chart right now. However, I can summarize the hypothetical scenarios for you:

Bearish Scenario:Gold prices gradually increase from around $1,950 to $3,300 per ounce over the next 10 years.

Base Scenario: Gold prices see moderate growth, moving from $1,950 to $2,400 per ounce. Bearish Scenario: Gold prices decline from $1,950 to $1,500 per ounce over the same period. These scenarios are purely speculative and depend on various economic and geopolitical factors. For an actual forecast, it would be best to consult financial experts and use real-time data analysis tools.

Benefits of AI-based gold price forecasting

AI-based gold price forecasting offers several benefits, particularly for traders, investors, and financial institutions. Here are some of the key advantages:

1. Improved Accuracy: AI algorithms, such as machine learning and deep learning models, can process vast amounts of historical and real-time data to identify complex patterns and trends that might be missed by traditional analysis methods. This leads to more accurate predictions of gold price movements.

2. Real-Time Analysis: AI systems can analyze data in real-time, providing up-to-the-minute forecasts. This is especially beneficial in the fast-paced forex market, where timely decisions can significantly impact profitability.

3. Data-Driven Decisions: AI-based forecasting relies on data rather than human intuition or emotions, which can lead to more objective and rational decision-making. This helps traders and investors avoid common psychological biases that might affect their trading strategies.

4. Ability to Process Large Data Sets: AI can handle large volumes of structured and unstructured data, including economic indicators, geopolitical events, market sentiment, and social media trends. This comprehensive analysis enables more robust forecasts that account for multiple variables affecting gold prices.

5. Pattern Recognition: AI excels in recognizing non-linear patterns in data. It can identify subtle correlations and causations that may not be immediately apparent, allowing for more sophisticated forecasting models that traditional methods may overlook.

6. Adaptability and Learning: AI models can learn and adapt to new data, improving their predictions over time. Unlike static models, AI-based systems can evolve based on new information, making them more responsive to changing market conditions.

7. Risk Managemen: AI can help in risk assessment and management by predicting potential downturns or identifying high-risk market conditions. This allows investors and traders to take preemptive actions to mitigate risks.

8. Cost-Effectiveness: AI systems can reduce the need for extensive manual analysis and human labor, making the forecasting process more cost-effective. Once an AI model is developed, it can operate autonomously, providing continuous insights with minimal additional costs.

9. Automated Trading: AI-based forecasts can be integrated with automated trading systems, enabling the execution of trades based on real-time data without human intervention. This can enhance trading efficiency and reduce the time lag between decision-making and trade execution.

10. Enhanced Strategic Planning: With accurate AI-driven forecasts, traders and investors can plan their strategies more effectively, optimizing their portfolios and hedging against potential market downturns.

11. Predictive Maintenance and Error Reduction: AI can continuously monitor market conditions and forecast models for potential errors or anomalies, providing predictive maintenance that reduces the likelihood of costly mistakes.

12. Market Sentiment Analysis: AI can analyze news articles, social media posts, and other sources to gauge market sentiment, which can be a significant factor in price movements. By incorporating sentiment analysis, AI-based models can provide more comprehensive forecasts.

By leveraging these benefits, AI-based gold price forecasting can significantly enhance decision-making processes, reduce risks, and potentially increase profitability for investors and traders in the forex market.